Prologue

I first signed up for Robinhood on March 17th, 2014. At that point in time, the product hadn't even launched yet, and I was one of thousands clambering to try a product that promised free trading. I had dabbled with investing through my Dad back in high school, and up to that point in college, the only investing I had truly done was open an E*Trade account. Robinhood represented something greater than zero-commission investing - it represented a whole new model for investing.

My beta invention wouldn't be sent for more than 6 months, landing in my inbox on September 23rd, 2014. That email specifically mentioned I had 72 hours to complete the application or my spot would be given to one of the 400K+ people still waiting in line. Much time later, I'm coming up on my four-year anniversary of joining Robinhood. To date, their maturity into a credible threat to the brokerage space has been nothing short of spectacular. A beautifully crafted product with a simple mission. Ideals that resonated with millions of Millennials and catapulted Robinhood to an almost $6B valuation.

There is still much room to grow, and as Robinhood eyes an IPO, they will continue to innovate to become a full-service financial firm. However, there is still one element that I believe Robinhood has a tremendous opportunity to capitalize on: education.

Customer Validation

Historically speaking, brokerage companies have truly only cared about their most wealthy investors. After all, with a business model that benefits from high net worth individuals and their propensity to place an abundance of trades (and collect those commissions), it's easy to understand why it typically isn't worth their time to land 100 new investors, with no more than a thousand dollars or so, versus the middle aged, tenured man with a portfolio already at six figures.

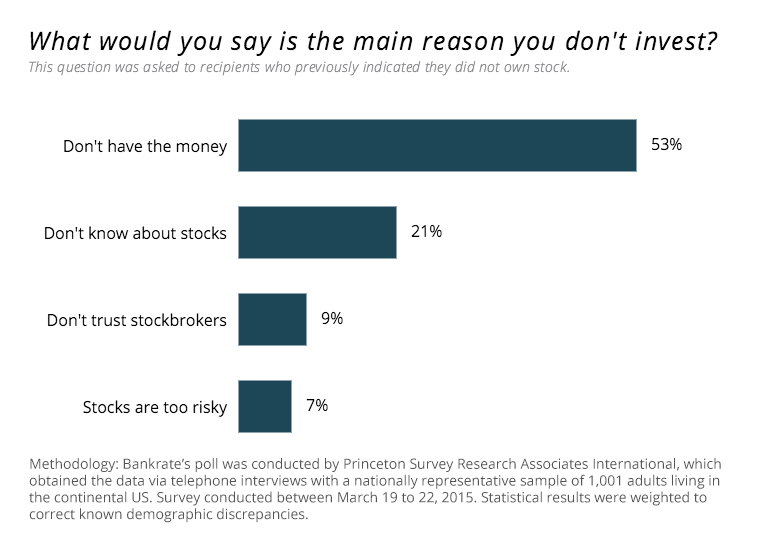

This is a bit naive given there's a massive opportunity to address the needs of a generation that doesn't yet abundantly understand the value of the markets. Of course, there is more than visible from the surface, and doing a little customer research goes a long way in understanding the problem Robinhood is solving (making finance more available, particularly the markets). I think Robinhood is only scratching the surface as to why, and there still remains an opportunity to close the knowledge gap. Here's a study from Bankrate I recorded back in college:

You'll notice an overwhelming number of respondents indicated they simply don't have the money. This is reasonable - making 8% on $100 for a whole year would result in a negligible return - $8. However, I would venture the benefit investing, even with small amounts such as this, is the belief that if you get people investing early, you're setting a good precedent for their future.

Think about it this way: if you can rationalize putting aside 10% of your salary now, imagine how much easier it will be in the future to continue to contribute in greater amounts. This is an example of a core concept of money (the time value of money), that isn't as widely understood as it should be.

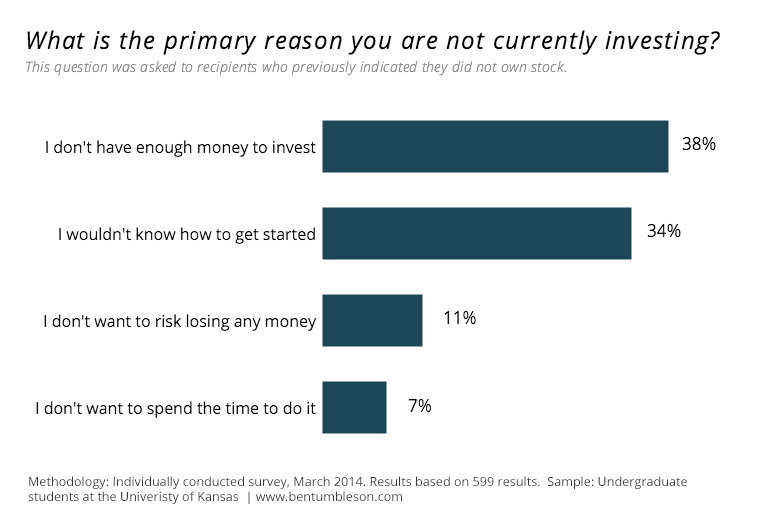

I ended up conducting my own study in college with students to see if their responses differed:

Here's where the responses get a little more interesting. A small majority of college students indicated they weren't investing because they didn't have the money to do it. My argument above remains true, but Robinhood makes this much more approachable with the zero-dollar commission punchline. If you aren't paying $7/ trade, then you're not losing a few percent of your entire trade, every time you trade (I'm assuming first time investors trades are small in nature).

However when you take it a step further, you see that there's almost another 50% of respondents (across Bankrate's survey, and mine with students), wherein fund availability is not the reason they aren't investing.

I wouldn't know how to get started/ don't know about stocks

I don't want to risk losing any money/ don't trust brokers

I don't want to spend the time to do it

Would you not agree with me that these are serious concerns of potential investors that still largely haven't been addressed? Don't get me wrong, Robinhood makes it dead simple to get started investing, but there is almost no direction given on how to invest.

Venture over to reddit's r/wallstreetbets and you'll find pages and pages of "investors" making increasingly reckless trades, typically on Robinhood. This isn't a slight to Robinhood, but I think it helps paint the narrative that first time investors could benefit from subtle financial education.

One More Example

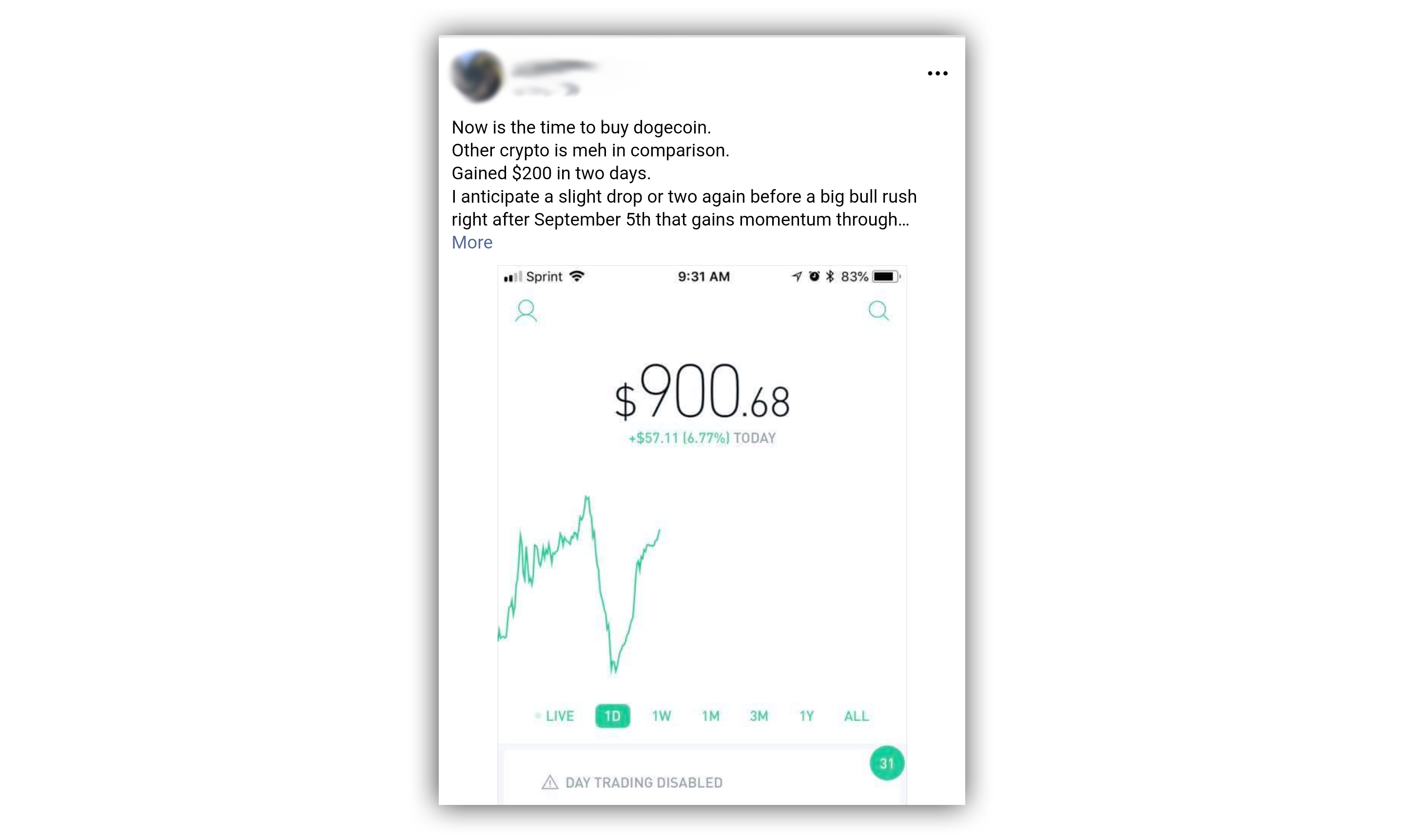

I want to share one more example I recently pulled from my Facebook feed. I regret that I still check Facebook a few times a week, but sometimes I come across gems like this:

Let me explain why this is an issue:

- I love seeing people my age investing, but let's be clear that Dogecoin is not investing, it's gambling:

- This "investor" is speculating and attempting to time the market. Burton Malkiel, best known for his book A Random Walk Down Wallstreet would call this a fool's errand:

- This "investor" has already hit their trading limit, smartly imposed by Robinhood to prevent this individual from being classified as a pattern or day trader (note the "Day Trading Disabled" message at the bottom). To quote Robinhood's own support documents on the matter:

With that in mind, the fact that this individual has already hit those caps tells me they are not equipped to be making rational investment decisions. Especially when you consider that the SEC states that you need at least $25,000 to not have these limits imposed. This individual has than than $1000."Pattern day trading rules were put in place to protect individual retail investors from trading in a potentially risky way."

"It was a piss take, my whole point of dogecoin was taking a jab at all these alt-coins that were coming on the scene — like Initial Coin Offerings are today — and, you know, basically making a cash grab." - Jackson Palmer, creator of Dogecoin, January 2018.

“…and the lesson about timing is: not only do you not know when to get in, you don’t know when to get out. And when you market-time you got to be right twice. You got to know when to get out and when to get in. And nobody and I really believe this: nobody but nobody can do that.” (72:30)

The Opportunity

Robinhood is at the forefront of democratizing financial access, and there is a tremendous opportunity to utilize the brand recognition, trust they've built, and exceptional design talent to complement their own products (current and upcoming) by providing financial literacy and teaching core investment strategies and philosophies to a largely uneducated, but interested audience.

These educational offering's will not only make investors collectively smarter, but more willing and rational to trust the markets across a range of investment vehicles. This will produce customers who are more likely to remain clients longer, grow their portfolios, utilize more services, reduce customer service requests, and ultimately better align their financial decisions to that of rational investors prepared for the long haul.

Example: User story

John is a recent college graduate, no more than a few years out of school. He has an engineering degree and a stable job which pays him a consistent salary. When he joined his company, he was told about their 401K program, including matching, but opted to skip it citing the need to pay down his students loans and not understanding much of the terminology involved.

He has been hearing about cryptocurrency and often receives company-wide emails detailing his firm's financial status and holdings. He decided to sign up for Robinhood citing the recommendation of his friends and how easy it was to get started. He's put a few dollars in Bitcoin, and a few companies he liked such as Tesla and Boeing.

He enjoys tracking his portfolio but doesn't enjoy the thought of so much fluctuation. The introduction of things like options trading is nifty, but largely do not make sense to John. He does not feel compelled to continually invest more funds into his portfolio, citing his general lack of understanding. "Investing" will just continue to be a hobby for him.

The opportunity: John should have an IRA and most definitely a 401K through his company. It's great he took the initiative to start investing, but his broker hasn't given him any direction to better understand what he's doing, and allow him to continue to grow. Recognizing that John signed up and indicated he had no experience, Robinhood has the opportunity to introduce John to other stocks (Robinhood is in the process of doing this through their collections and social features), begin to explain the concept of a balanced portfolio (not overweighting any one stock or industry, etc), and introduce new concepts such as ETF's (collections of stocks traded as one). As it becomes available, Robinhood can introduce John to the idea of an IRA and help him build a sustainable portfolio for his future.

How might we solve this?

Forgoing a team activity of brainstorming around a whiteboard, a useful exercise at this stage is to propose a range of potential solutions, asking the question how might we solve this?

Create simple infographic pop-ups that can be accessed from the "notification panel" that teach relevant lessons in bite-size chunks

Create mini-lessons that appear in context throughout the application, such as when searching for stocks, viewing an individual security, viewing the overall status of your portfolio, etc.

Create other "tabs" on the main screen for viewing other statistics about your portfolio, such as sector weighting (with recommendations for diversification), and statistics regarding historical returns and risk

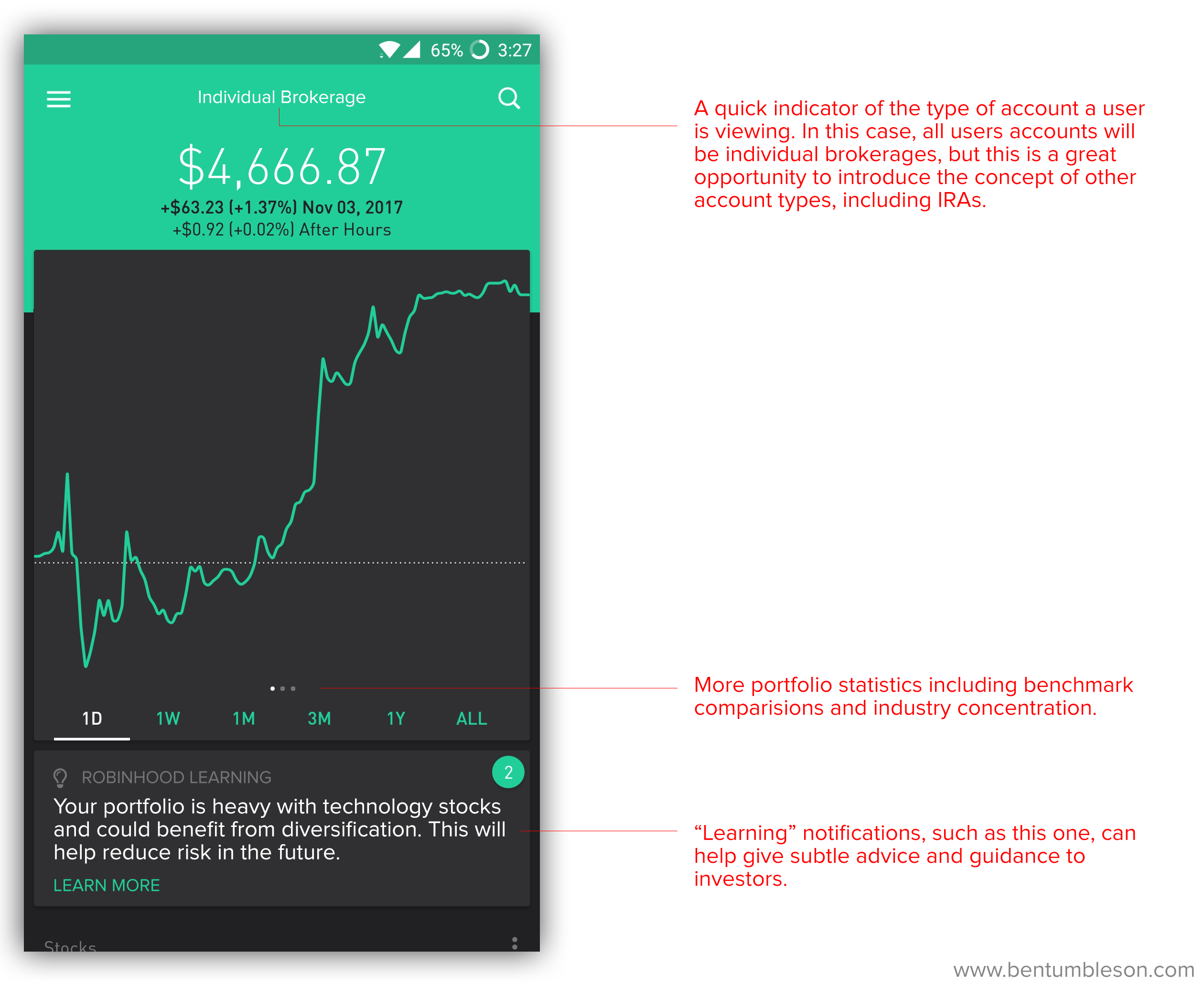

Add a tooltip/ designation to the top of the home screen that denotes the account as a "individual brokerage account" - this gives you the opportunity to explain on a new page different types of accounts, specifically brokerage vs retirement

Use "Collections" as a way to show sample portfolios, extending their capability from just a grouping of related stocks. For example, show recommended portfolios of gurus, suggesting similarity to a user's current one

Extend the Options trading "Discover" feature to stocks as well, to discover stocks based on themes such as big data or immunotherapy

Give users portfolios a "risk score" proportional to their age and the allocation of assets. Most users will naturally score high with their poorly diversified portfolios, but this actual direct feedback that may be of interest to a user

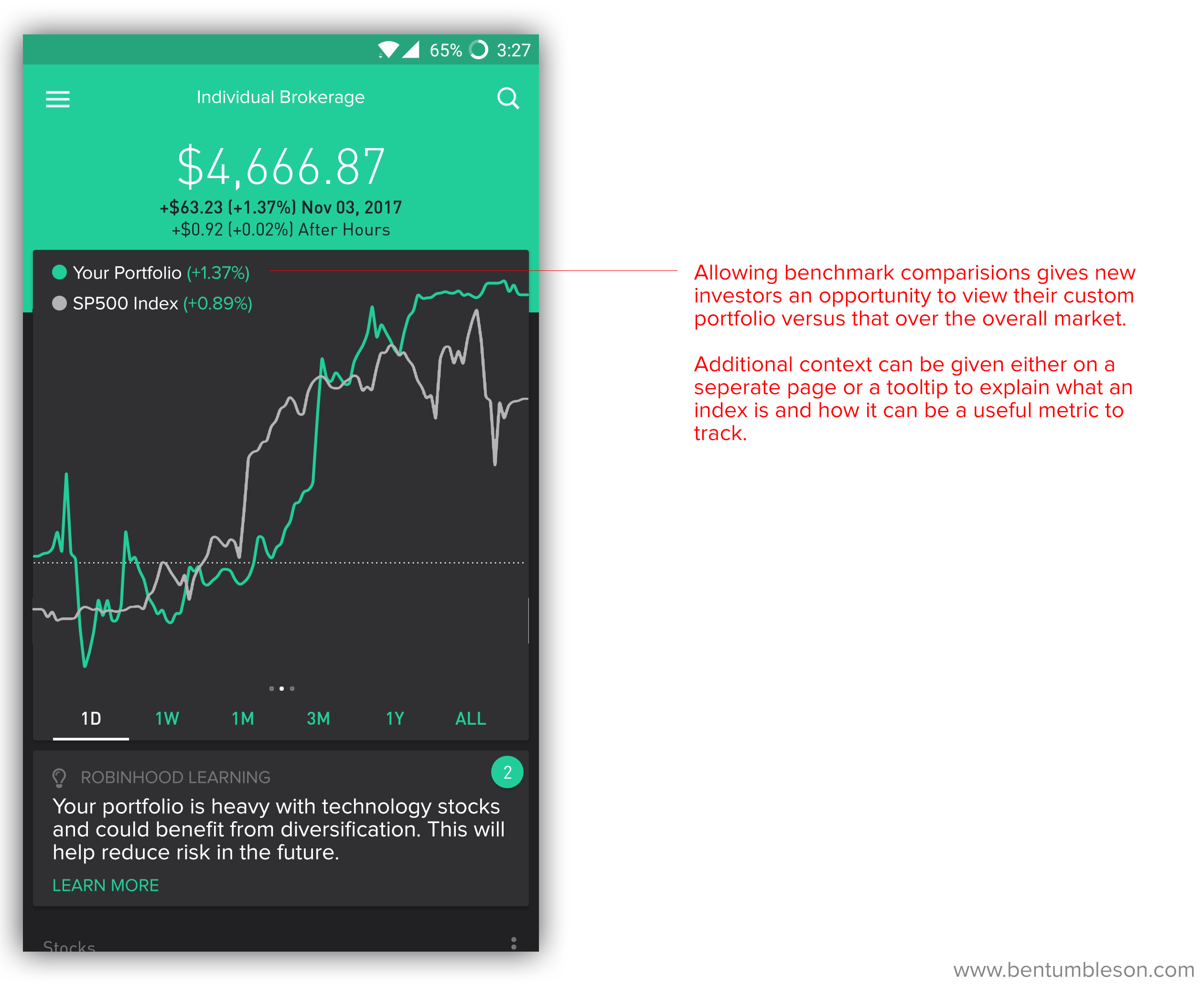

Give portfolio return statistics versus the overall market (SP500/ DJIX, etc)... allows a user to visualize on a YTD basis how they are tracking versus a benchmark (as this concept hasn't truly been introduced yet)

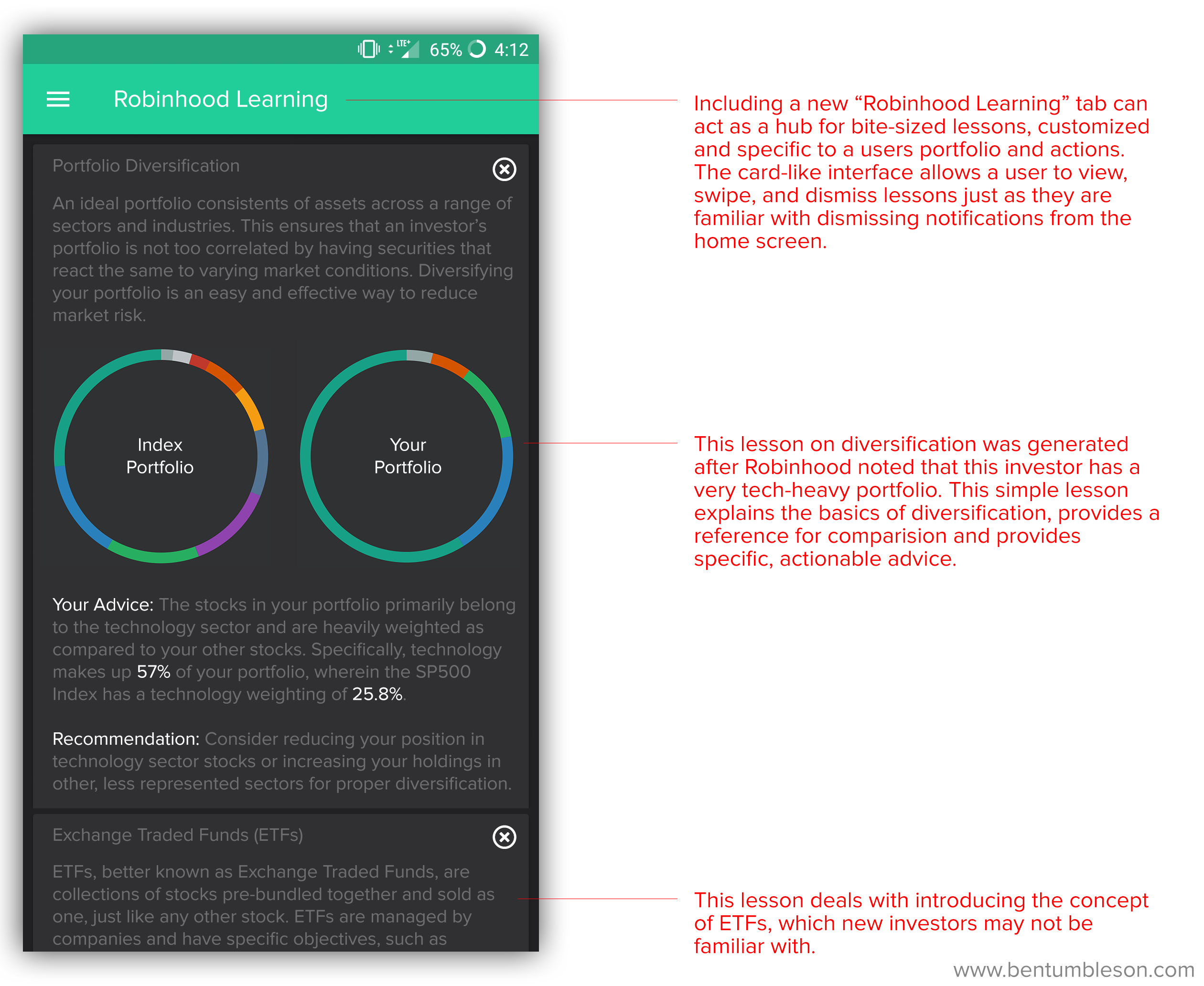

Pen to Paper

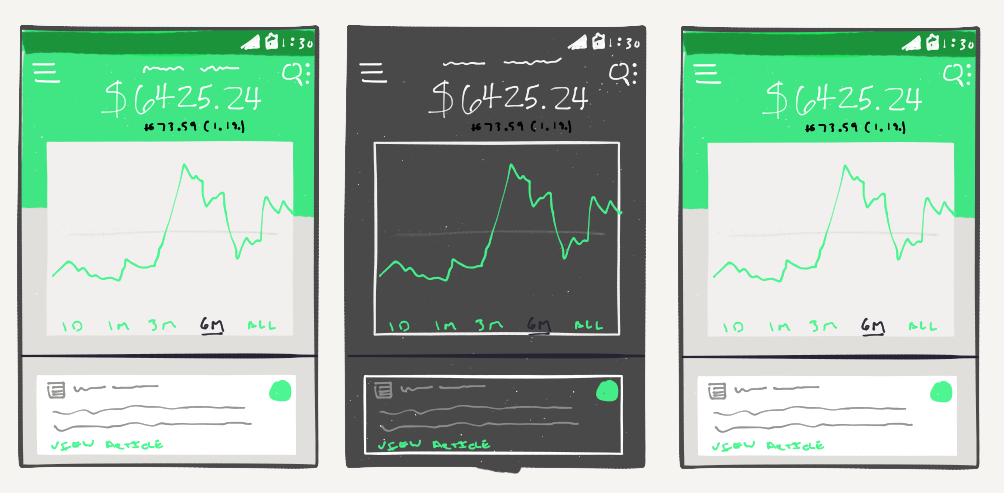

As I began taking my ideas and translating them into tangible concepts, I started sketching out Robinhood in my favorite design app. While drafting out some rough ideas, I came to understand that the common theme Robinhood could benefit from is a central "learning" center. All of the context-specific help is fantastic, but it all feels a bit wasted if there isn't a central repository to store and share these lessons.

With a few ideas sketched out, I switched to Photoshop and started mocking a few simple ideas. While seemingly random in addition, I believe each addition above and as depicted can be elegantly woven together:

If we take it a step further, you can see how simple ideas can begin to build on each other to provide a cohesive experience to users.

Finally, let's tie together these simple quality-of-life improvements with the driving theme: an opportunity to provide simple, quality financial advice. Designed to make investors (particularly new ones) more informed and drive better decision making to help support their financial futures.

This "learning center" has limitless topics that can be tailored to users, their portfolios, experience investing, and ongoing investment decisions. For beginners, lessons can include:

- Understanding the time value of money and compounding

- Different assets classes, and how they work to control portfolio risk

- Portfolio diversification, and not putting all of your eggs in one basket

- The fallacy of trying to time the markets, and why it isn't a sound strategy

As a user matures, you can begin introducing more advanced concepts, such as:

- Deep dive: What makes a company a good buy? Understanding earnings calls

- Options basics and multi-leg strategies

- Understanding Modern Portfolio Theory (MPT)

Conclusion

Robinhood has a unique audience that is poised to be responsive to modest educational opportunities that will not only allow them to become better informed about the decisions they're making, but allow Robinhood customers to grow and continue to utilize the products and services offered.

As Robinhood continues to invest in its offerings, and its goal to become a full-service financial firm, they can realize continued corporate social responsibility by introducing educational opportunities to their clients. This will help reaffirm brand loyalty and help continue to solidify success in new products and services.

Other graphics made by me.

Member discussion: